The Employment Situation in March

By Chair Cecilia Rouse

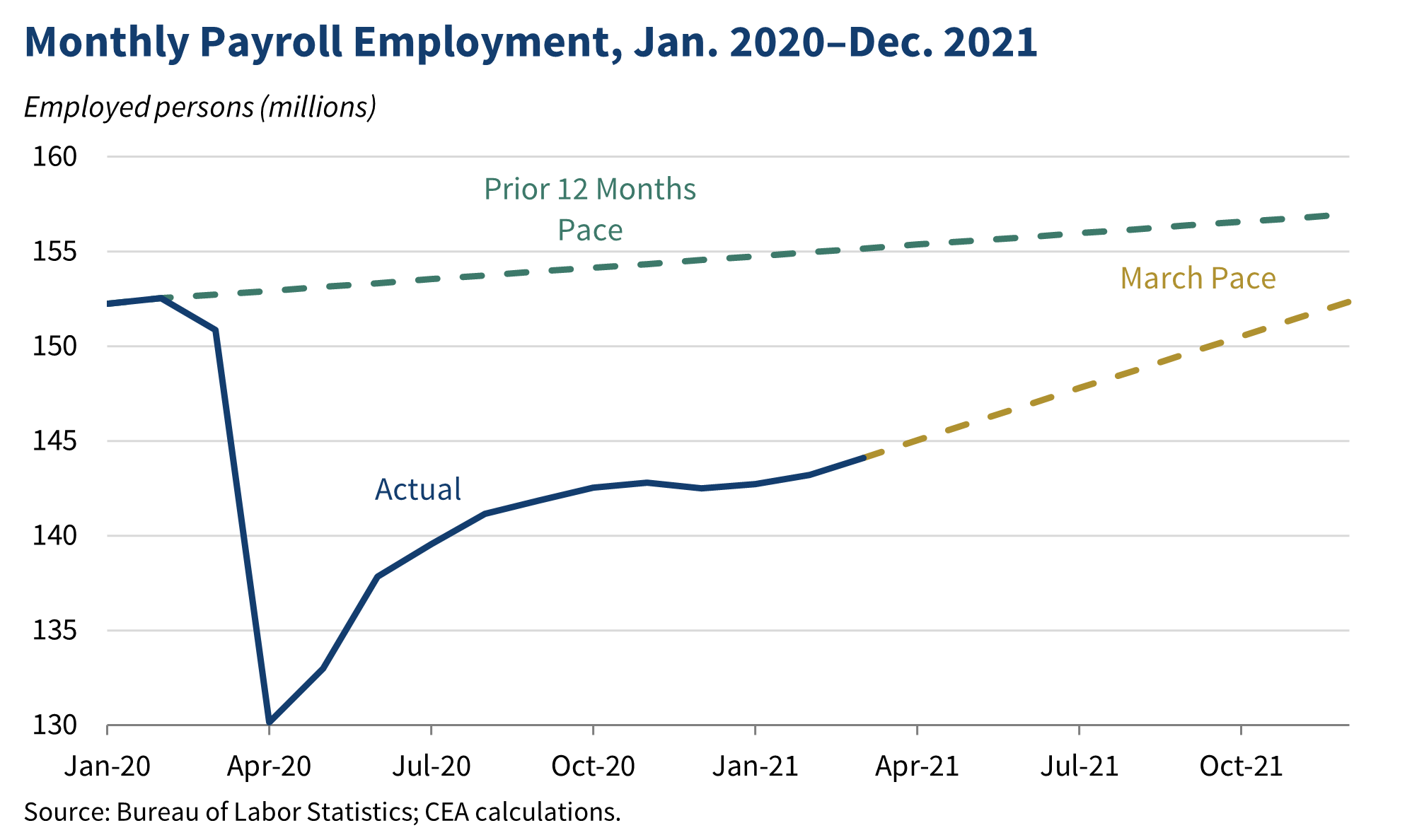

Today’s jobs report showed marked acceleration in March to the fastest pace since August of last year. The economy added 916,000 jobs in March, and job growth was revised up in both January and February. Although there were 8.4 million fewer jobs in March than in February 2020, assuming the current pace of job growth holds, employment could be back to pre-pandemic levels around the end of this year.

This month’s jobs report marks one year since the first pandemic job losses. This blog focuses on how different parts of the economy are doing as of this milestone.

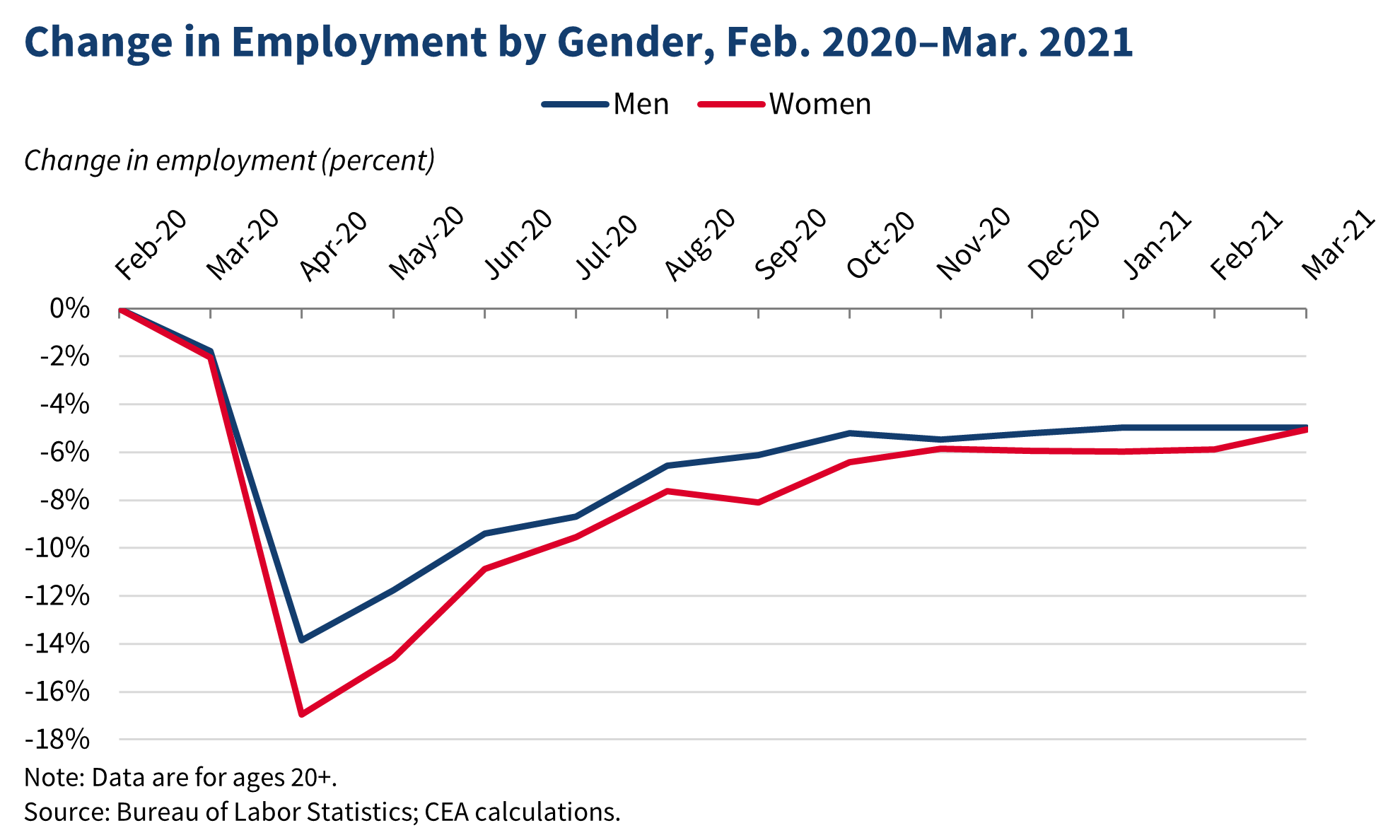

1. In March, women’s employment losses finally narrowed to about the same decline as men have experienced.

Since the beginning of this recession, women’s employment, as measured by the household survey, had fallen by more than men’s employment in percent terms. In March, however, women’s employment losses as a percent of employment finally neared the same point as men’s employment losses: employment for both men and women is now lower than it was in February 2020 by about 5 percent. In numeric terms, women’s employment losses are somewhat smaller (-3.7 million) than men’s (-4.0 million), but because fewer women were employed back in February, these losses represent about the same percent fall in employment for women and men.

The narrowing of the male-female employment loss gap reflects strong growth in household employment for women in March. The employment-population ratio for adult women jumped to 54.1 percent, while it ticked down by 0.1 percentage point for adult men to 65.4 percent. The increase was particularly large for Hispanic women, whose employment-population ratio jumped by 1.1 percentage point. However, employment for Hispanic women remains 6.5 percent below the February 2020 level.

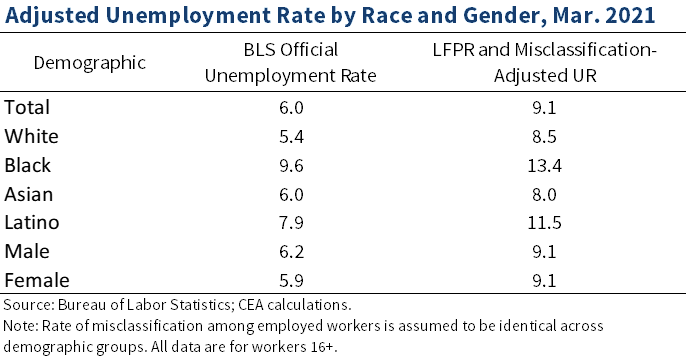

2. Adjusting for labor force dropout and misclassification, the effective unemployment rate could be around 3 percentage points higher than the headline unemployment rate.

In March, the headline unemployment rate dropped to 6.0 percent, 2.5 percentage points above the rate in February 2020, before the pandemic sent many workers home and shuttered businesses and schools. Given the way the Bureau of Labor Statistics identifies and defines unemployed workers, the headline unemployment rate likely understates unemployment in a pandemic relative to a typical downturn. Since February 2020, almost 4 million workers have dropped out of the labor force. Accounting for labor force dropouts and misclassification issues related to BLS’s survey questions implies an unemployment rate around 9 percent. Unemployment rates also vary substantially across groups, based on either the official unemployment rate or an adjusted rate. Again, Black and Latino workers have been particularly hard hit, with the adjusted rates for both remaining in double digits.

3. Our economy has 8.4 million fewer jobs than the pre-pandemic peak.

On the payroll side, there were 8.4 million fewer jobs in March than in February 2020. Job growth has accelerated the past few months, which has helped narrow the jobs gap and is putting our economy on track to regain the jobs lost in the pandemic.

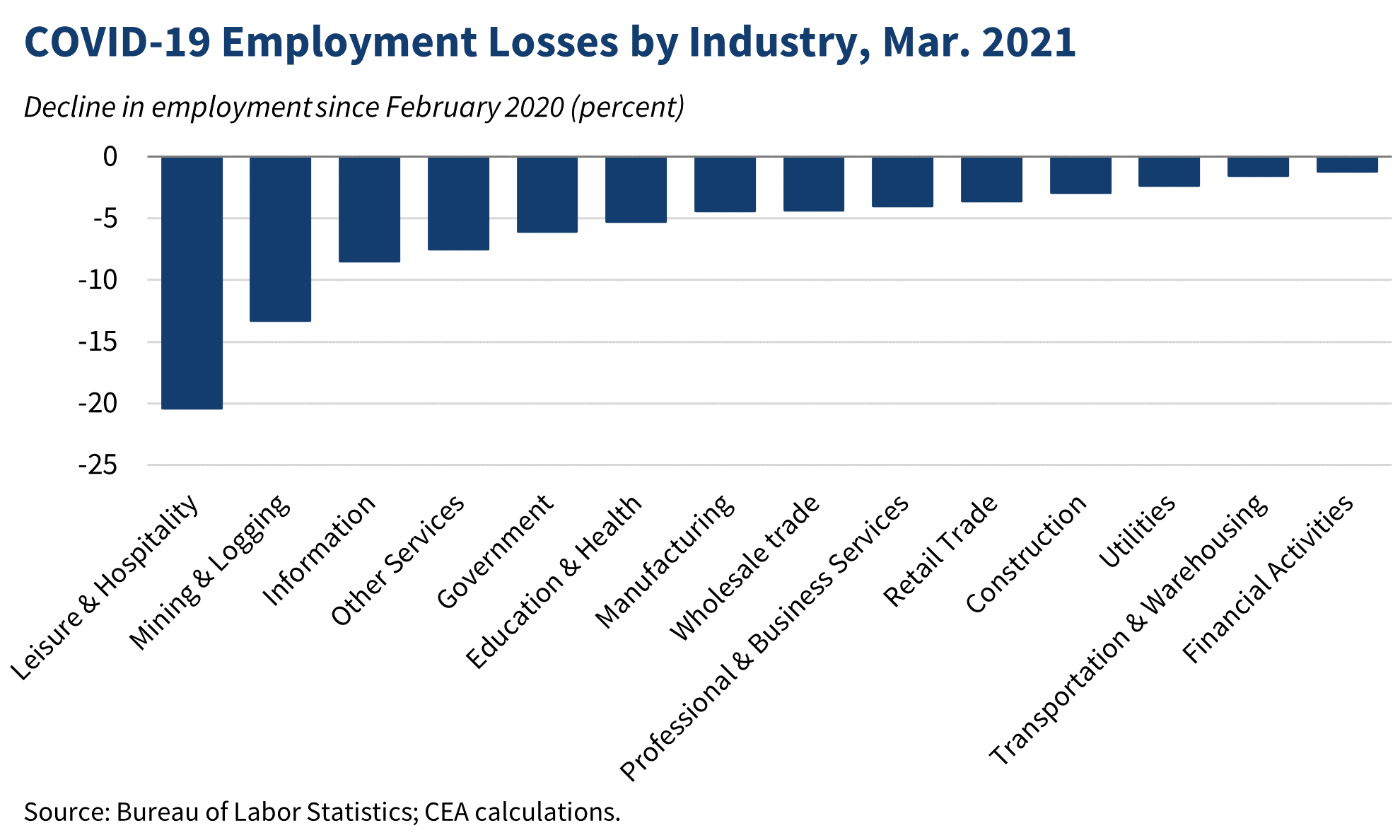

4. Job gains were widespread in March. The largest gains were in leisure and hospitality, which remains hard-hit, but construction, education and health services, and state and local government also added substantial numbers of jobs.

The vast majority of industries added jobs in March, with particularly notable gains in leisure and hospitality, construction, education and health services, and government. State and local education employment added 125,600 jobs in March, accounting for 92 percent of the jobs added in government.

Despite the gains in March, many industries are still working their way back from their pandemic losses. At the sector level, by far the worst hit industry is leisure and hospitality, with 19 percent fewer jobs than in February 2020. This industry alone accounts for around 40 percent of the remaining pandemic job loss.

However, not all industries have suffered in the pandemic. For instance, employment in couriers and messengers is up around 23 percent, and employment in building material and garden supply stores is up around 7 percent.

Industries with Highest Employment Relative to Feb. 2020, Mar. 2021

| Industry | Change in employment |

|---|---|

| Couriers & Messengers | 23.3% |

| Building Material & Garden Supply Stores | 7.3% |

| Warehousing & Storage | 6.5% |

| Scientific Research & Development Services | 4.3% |

| Monetary Authorities – Central Bank | 3.6% |

| Other Information Services | 3.6% |

| Nonstore Retailers | 3.3% |

| Food & Beverage Stores | 2.9% |

| General Merchandise Stores | 2.6% |

| Securities, Commodity Contracts, Investments/Funds/Trusts | 1.0% |

Other industries, particularly in leisure and hospitality, have struggled to find a way forward in the pandemic. Employment in motion picture and sound recording is down over 40 percent while performing arts and spectator sports is down around 34 percent since before the pandemic, reflecting that it is difficult for those industries to conduct business in a socially-distanced way. Many of the industries that are down the most will continue to struggle until the pandemic is fully under control.

Industries with Lowest Employment Relative to Feb. 2020, Mar. 2021

| Industry | Change in employment |

|---|---|

| Motion Picture & Sound Recording Industries | -40.3% |

| Performing Arts & Spectator Sports | -33.6% |

| Accommodation | -29.5% |

| Amusements, Gambling & Recreation | -27.1% |

| Museums, Historical Sites & Similar Institutions | -24.7% |

| Transit & Ground Passenger Transportation | -22.8% |

| Clothing & Clothing Accessories Stores | -22.7% |

| Scenic & Sightseeing Transportation | -20.7% |

| Support Activities for Mining | -20.7% |

| Air Transportation | -20.1% |

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision. Therefore, it is important not to read too much into any one monthly report, and it is informative to consider each report in the context of other data as they become available. Household survey data beginning January 2021 reflects updated population estimates from the U.S. Census Bureau. This update affected headcounts of men’s and women’s employment roughly equally and so did not materially affect the gap between men’s and women’s job losses (see Table B from the January 2021 Employment Situation).