Bringing Infrastructure into the 21st Century

By Heather Boushey

Infrastructure provides the foundation for economic activity, yet the pace of investment has fallen behind in the United States and hindered economic growth and competitiveness. From roads and transportation systems, to water and waste transport, to broadband, to the power grid, infrastructure enables the economy to function. Time and again, analyses quantifying the effects of this kind of public investment show that they support economic growth. Many of the reasons that investments in infrastructure are economically usefully are direct and intuitive—a nation with bridges built to support the traffic flow clearly facilitates the transport of goods and people, which is imperative to economic activity. Even so, U.S. public investments have failed to keep pace with need.

The failure to invest in infrastructure creates new risks to the nation’s economy. Many of our major capital investments were made generations ago and now need maintenance. Moreover, innovation has changed how work is done, creating the need for new kinds of infrastructure, such as access to the internet. And, looming in front of the nation is the reality of climate change, where investments are necessary to smooth the transition to clean energy, facilitate private shifts toward climate-friendly industries, and increase economic resilience.

It is for these reasons that the Bipartisan Infrastructure Deal, which passed Congress on November 6th, makes historic investments in modern infrastructure. In addition to addressing the deferred maintenance of our bridges and roads, these investments will ensure that all Americans can benefit from broadband and that we make substantial progress in addressing climate change with electricity transmission, public transit, and electric vehicles. While the impacts of climate change make these investments urgent, low interest rates also mean that they are at their most cost-effective now.

Physical infrastructure supports growth

For millennia, governments have invested in basic infrastructure, such as roads, bridges, and waterworks, understanding that these investments support economic activity. Yet, the United States has been falling behind. Public investment in domestic infrastructure as a share of GDP has fallen by more than 40 percent since the 1960s, and the World Economic Forum now ranks the United States 13th when it comes to the overall quality of infrastructure. Dramatic examples of our nation’s aging infrastructure abound: in 2007, the I-35 bridge over the Mississippi River in Minneapolis collapsed during rush hour, killing 13 and injuring 121; in 2015, a state of emergency was declared in Flint, Michigan as citizens learned that their water supply contained toxic levels of lead; and in 2020, the COVID-19 pandemic revealed the harms caused to businesses and families without access to broadband internet.

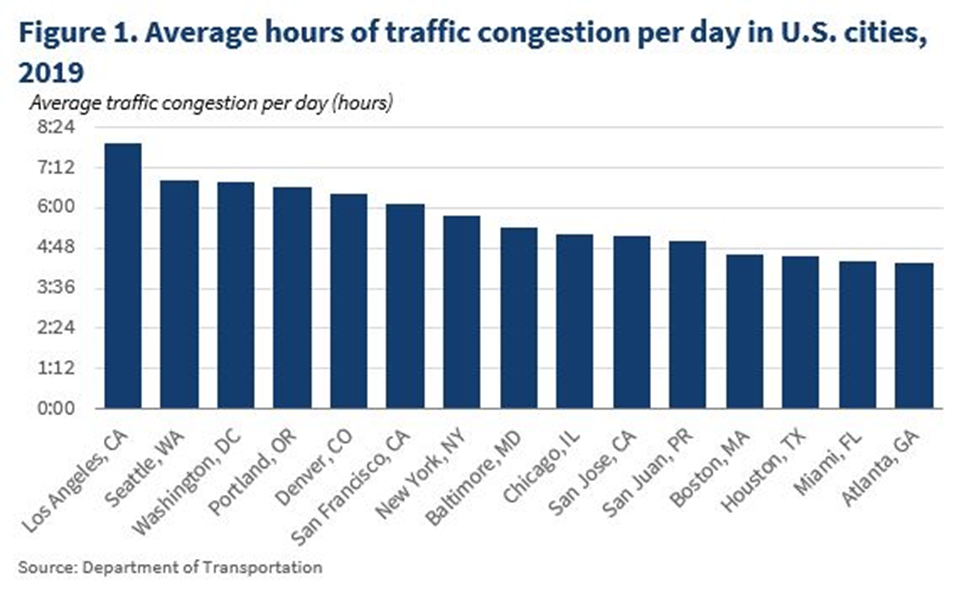

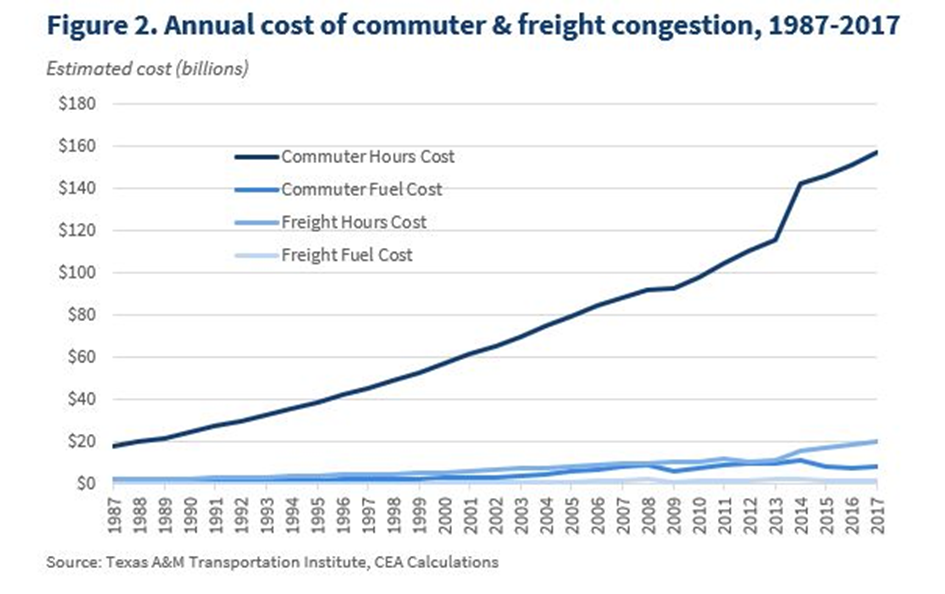

Our infrastructure also fails in more routine ways. The American Society of Civil Engineers estimates that one out of 14 of the nation’s bridges—more than 45,000—are in poor condition, along with one in five miles of roads. At the same time, costs of congestion are mounting. In many U.S. cities, roads are congested for more than four hours each day, causing travel delays and unreliability (Figure 1). In 2017, the aggregate cost of congestion for commuters reached almost $160 billion (Figure 2).

The implications of congestion go beyond productivity. More than 30,000 people die in traffic accidents on U.S. roads each year, and motor vehicle crashes are the leading cause of death among children. Measures as basic as improving road safety and investing in appropriate infrastructure can decrease mortality.

Routine failures of infrastructure also include the water system, as lead pipes still service millions of people. Removing these pipes has important economic benefits; an analysis from the Minnesota Department of Health found that removing the two most significant sources of lead over 20 years would have benefits twice as large as the costs, with improved population mental acuity and IQ ultimately increasing lifetime productivity, earnings, and taxes paid. Human exposure to lead has irreversible health effects; there is no safe level of exposure for children.

And while the COVID-19 pandemic made clear to businesses and families the importance of broadband internet for growing a business, participating in work, or attending school, millions of Americans remain without access, either due to high costs or limited availability in the place where they live. Even before the pandemic, researchers found that broadband internet adoption in rural areas had economic benefits, potentially increasing income growth, the number of firms, and total employment numbers, while decreasing unemployment growth.

In an analysis of 68 studies between 1983 and 2008, economists find that across various kinds of infrastructure, for each 10 percent increase in public capital supplied at the central government level, national output grew by 0.8 percent in the short run and 1.2 percent in the long run. Much of this effect is through supporting productivity: one analysis finds that a 1 percent increase in public capital investments in core physical infrastructure had a 0.24 percent increase in productivity. At the same time, public investment in infrastructure spurs private investment; Pereira (2001) estimates that a public investment of $1 into electric and gas facilities, transit systems, and airfields leads to a $2.38 increase in long-term private investment.

Many of the economic gains of infrastructure are concentrated at the bottom of the income distribution, meaning that infrastructure investment can help promote equity. By one estimate, a 1 standard deviation (7 percentage point) increase in the growth rate of public investment in highways over a decade would erase almost two-thirds of the increase in income inequality observed between 2000 and 2010. Another study concludes that increasing infrastructure spending from 2 percent to 5 percent of GDP increases the wealth share of the bottom quintile from 3.95 percent to 4.49 percent.

Infrastructure investment is critical for climate resilience, adaptation, and the facilitation of green technologies

The Bipartisan Infrastructure Deal confronts the reality that the United States needs infrastructure that mitigates and adapts to the immense projected damages of climate change. This requires helping U.S. communities increase their resilience to climate change while also facilitating a move to net zero carbon emissions. After all, infrastructure is necessary to support the growth of clean energy technologies and, therefore, to the success of the broader Build Back Better agenda.[1]

Hurricane Ida, a category 4 storm that hit New Orleans in August of 2021, provides a striking example of the importance of resilience and the ongoing need for continued investment. Despite the severity of Ida, flooding was actually limited due to a new storm protection system installed by the Federal government in the wake of Hurricane Katrina, which caused a humanitarian catastrophe—and over $100 billion in damages—when the city’s levees failed. Importantly, however, shortcomings in the city’s electricity grid meant that millions lost power and hundreds of thousands remained without it for days, leading to at least nine deaths caused by excessive heat during the power outage and producing repair costs estimated at over $2 billion.

The power outages in the wake of Ida, as well as the Texas freeze in early 2021 that left roughly 10 million Texans without electricity and cost an estimated $155 billion nationwide, highlight the need to modernize the nation’s electric grid. One Department of Energy study finds that power outages cost the U.S. economy up to $150 billion annually. Without careful planning, these costs to the electricity grid will grow due to the increased frequency and severity of extreme events caused by climate change. Investments in electricity transmission can unleash the full potential of renewable energy by enabling more power to be delivered to urban centers from the windiest and sunniest parts of the country, and in turn, save households money and make the economy more resilient. One estimate finds that investments in the eastern U.S. transmission grid could reduce energy bills by at least 33 percent.

Reforming the transportation sector is also critical to addressing climate change. In 2019, 29 percent of U.S. greenhouse gas emissions came from transportation. In order to meet President Biden’s climate goals and mitigate damages in the coming decades, the United States will need to move away from fossil fuel-powered vehicles and towards public transit and rail, and electric vehicles (EVs).

While EVs are increasingly cost-competitive with fossil fuel-powered cars, their market shares remain in single digits. For those interested in purchasing electric vehicles, a major barrier is the relatively limited availability of charging stations. Strategic investment can greatly increase the share of people whose car needs can be fulfilled with electric vehicles. Consider Norway, where the Federal government has committed to supporting EVs; last month, over three-quarters of total car sales were electric.

Promoting access to public transit can also support the transition to a net zero carbon economy. One estimate from the Department of Transportation (DOT) finds that U.S. bus transit emits an estimated 33 percent lower greenhouse gas emissions per passenger mile than the average U.S. personal vehicle. The same DOT study finds investments in hybrid electric buses would further decrease greenhouse gas emissions.

Reducing emissions not only addresses climate change but also supports health and well-being in ways that will improve productivity now and far into the future. School buses, for example, make up 80 percent of all buses in the United States, and the majority run on diesel, which emits exhaust fumes that are detrimental to human health and can cause asthma. Electrifying the entire U.S. school bus fleet would not only reduce overall bus emissions by 35 percent per year, but in doing so, improve the current well-being and future productivity of American students who would inhale cleaner air on their ride to school. Austin et al. (2019) estimate that retrofitting an entire school district’s fleet of diesel buses to reduce emissions by 60 to 90 percent can increase English test scores by 0.14 standard deviation when all students ride the bus.

Why now?

Infrastructure reform is long overdue. We are not only living with broken 20th century roads and bridges, but are missing out on the advances of 21st century, such as state-of-the-art automation and fast broadband. Failing to make these investments hurts the competitiveness of American businesses and the economic security of American families. Now is also the time to invest in infrastructure that supports the move to net zero carbon emissions. By one estimate, every decade of delayed action on climate change doubles the cost of decarbonization.

Already, the United States is paying a high price for delaying action to stand up the infrastructure necessary to address climate change. The last seven years have been the warmest on record, and 2020 was tied for the warmest single year on record. Economic damages from climate change come in multiple forms, including more intense hurricanes that cost billions of dollars in damages every year, drier and hotter conditions that make forest fires more likely, and warmer weather that reduces crop yields. In 2020, major extreme weather and climate events cost the United States $100 billion. This summer, nearly one in three Americans lived in a county hit by a weather disaster. Americans pay for the costs of extreme weather directly, by, for example, fixing flooded basements, but also indirectly, by facing mounting insurance costs.

Climate action also provides other benefits, including for health. Heat exposure alone is estimated to cause 12,000 premature deaths annually in the continental United States, 37 percent of which (between 1991 and 2018) were attributed to anthropogenic climate change. By the end of the century, deaths from heat exposure are expected to increase by 36,000 per year in a moderate emissions scenario and 97,000 per year in a high emissions scenario. And, local air pollution produced by fossil fuel combustion causes premature death, exacerbates existing health conditions (especially among lower-income groups and communities of color)—which can lead to higher infant mortality —and reduces worker productivity,

Reducing the risks of climate change has important equity implications. Because climate change tends to hit low income regions and individuals harder, it widens existing economic inequality. In one study estimating the economic damage of climate change in the United States, the poorest decile of counties is projected to suffer median losses that are 9.5 times larger than the richest decile of counties, when losses are measured as a percentage of baseline income.

Now is also the time to make these investments from a financing perspective. The costs of borrowing remain at historic lows. Real interest rates—the yield on U.S. Treasury securities less observed inflation—are the price the government pays to borrow money from the private sector, which includes both households and firms. For the first time since 2013, real 10-year interest rates on U.S. treasury securities have remained below zero for over a full year. Considering that new government debt would go towards increasing long-term growth, the downsides of increasing the debt are small in comparison to the benefits of this much needed infrastructure. As the 2022 Federal Budget lays out, the burden associated with the debt is the level of interest payments; given low interest rates, additional capital investments would be affordable. Low rates are also a signal of the market’s confidence that the U.S. government will continue to pay its debts on time.

Though under some circumstances, deficit-financed funding can decrease long-term output by crowding out private investment, the current availability of funds for private actors signals that crowd-out is unlikely. Low rates indicate that there is sufficient supply of capital to meet demand and that businesses are not struggling to find funding. In fact, corporate profits are at an all-time high (up 37 percent since the fourth quarter of 2019), another indication that debt-servicing costs are not prohibitive. All of this suggests that markets are willing to lend funds to the government so that it can make economically important investments.

Conclusion

Investments in America’s infrastructure have the potential to boost long-run productivity and deliver broad-based economic growth that reaches communities across America. Importantly, these investments also can advance climate resilience and reduce inflationary pressures. The country cannot continue to thrive in the 21st century with ailing 20th century infrastructure. The time is now to make these investments.

[1] Congress passed the Bipartisan Infrastructure Deal (Infrastructure Investment and Jobs Act) on November 6th, 2021. As of November 6th, 2021, the Build Back Better Act is being debated in the House of Representatives.