How Do Economists Determine Whether the Economy Is in a Recession?

What is a recession? While some maintain that two consecutive quarters of falling real GDP constitute a recession, that is neither the official definition nor the way economists evaluate the state of the business cycle. Instead, both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data—including the labor market, consumer and business spending, industrial production, and incomes. Based on these data, it is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession.

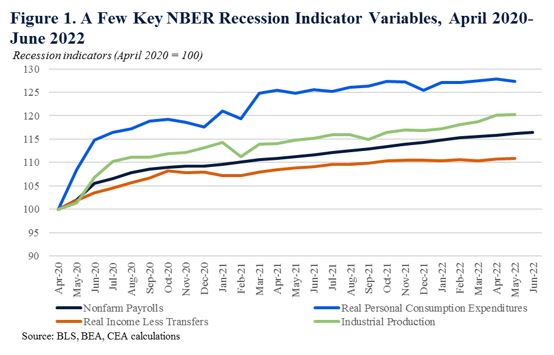

The National Bureau of Economic Research (NBER) Business Cycle Dating Committee—the official recession scorekeeper—defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” The variables the committee typically tracks include real personal income minus government transfers, employment, various forms of real consumer spending, and industrial production. Notably, there are no fixed rules or thresholds that trigger a determination of decline, although the committee does note that in recent decades, they have given more weight to real personal income less transfers and payroll employment.

Also, because the committee depends on government statistics that are reported at various lags, it cannot officially designate a recession until after it starts.[1] So how might the NBER committee assess the health of the economy?

Figure 1 shows the trend in four of the NBER committee’s recession-indicator variables—real income minus transfers, real spending, industrial production, and employment—relative to their values in April 2020 (the trough of the last recession, and thus, the month before the current expansion began). All of these indicators have exhibited strong growth in the U.S. economy since the start of the pandemic, and have continued to expand through the first half of this year. And while real income net of transfers has been flat in recent months, industrial production, employment, and real spending have grown this year. The committee does not directly consider inflation; however, it is embedded in the real income and spending variables it tracks, including those plotted in Figure 1. Those data show that while inflation is highly elevated, real spending is still growing, powered by one of the strongest labor markets on record and an elevated stock of household savings.

The fact that the NBER committee looks for a “significant decline” in activity that is broad-based puts this year’s 1.6 percent rate contraction in first quarter real GDP into context. Far from being a broad contraction, the negative estimate of the growth rate was a function of inventories—one of the noisiest components of GDP growth[2]—and net exports, in part reflecting our economic strength relative to that of our trading partners, as well as less snarled global supply chains. Private domestic final demand—consumer spending and fixed investment (which together make up over 80 percent of nominal GDP)—grew at a 3.0 percent real annualized rate in the first quarter, demonstrating solid, above-trend growth. And payroll employment grew at an even stronger 4.7 percent annualized rate, followed by 3.4 percent in Q2. In fact, the 1.1 million jobs created in the second quarter—an average of around 375,000 jobs per month—is more than three times more jobs created than in any three-month period leading up to a recession.

Finally, although the unemployment rate is not on the committee’s list, the fact that it has held at a historically low 3.6 percent in the past four months also has bearing on the recession question. A widely cited indicator of recessions (the “Sahm rule” named after economist Claudia Sahm) maintains that a recession is likely underway when the three-month moving average of the unemployment rate rises by at least half a percentage point (50 basis points) relative to its lowest point in the previous 12 months. The fact that the Sahm indicator is 0, far below its 50 basis-point threshold, provides yet another indication that the economic expansion is ongoing.

Recession probabilities are never zero, but trends in the data through the first half of this year used to determine a recession are not indicating a downturn.

Looking ahead, we know that the U.S., along with the rest of the global economy, faces significant headwinds—and little relevant data are yet available on the third quarter (2022Q3). At the same time, there is a good chance that the strength of the labor market and of consumer balance sheets help the economy transition from the rapid growth of the last year to steadier and more stable growth. But, whatever path the economy takes, CEA will continue to carefully track these indicators to assess the state of the economic cycle.

[1] In fact, when recessions are short-lived, the committee typically announces them after they are over.

[2] Inventories in the GDP accounts reflect not a level change, as for example, with consumer spending, but a change in a change, i.e., whether inventories were growing or shrinking faster or slower than the previous quarter. In fact, the level of inventories rose in 2022 Q1, just not as fast as in the previous quarter.