The Employment Situation in July

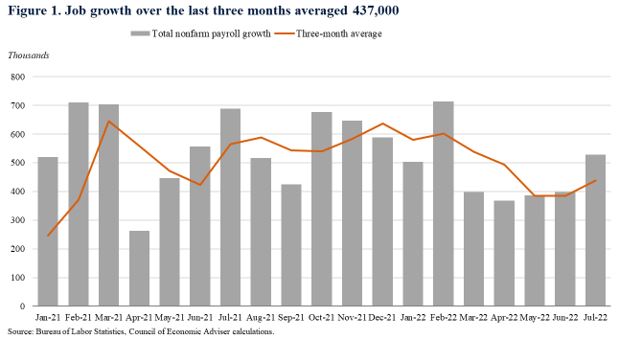

Today’s jobs report shows that the economy added 528,000 jobs in July, for an average monthly gain of 437,000 over the past three months. The number of jobs added in July came in far above market expectations. Employment in May and June was revised up by 28,000 jobs. The level of nonfarm employment now exceeds its February 2020 level.

The unemployment rate ticked down to 3.5 percent, reaching its pre-pandemic level. The labor force participation rate ticked down to 62.1 percent. Nominal wages have risen by 5.2 percent over the last year.

- Average monthly job growth over the last three months was 437,000, a fast pace, but a slowdown from the average in the winter.

Job growth in May, June, and July averaged 437,000 jobs per month (Figure 1). Since monthly numbers can be volatile and subject to revision, the Council of Economic Advisers prefers to focus on the three-month average rather than the data in a single month, as described in a prior CEA blog.

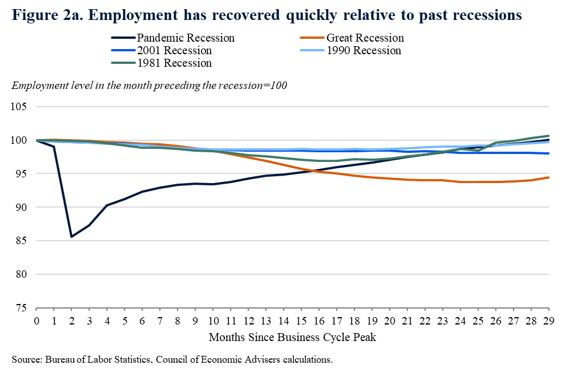

2. In July, total nonfarm employment fully recovered to its pre-pandemic level as did the unemployment rate.

As of July, the economy has reached its pre-pandemic employment level. As seen in Figure 2a, this recovery has been relatively fast. The only other recent recession that had regained all the jobs lost at this point in the recovery was the 1981 recession, which did not see nearly as dramatic job loss as the 2020 recession. In the Great Recession, employment took more than six years to fully recover.

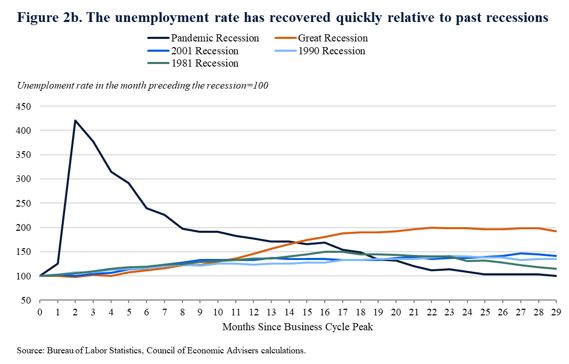

The unemployment rate has also fully recovered to its pre-pandemic rate of 3.5 percent. There are no recent recessions that have seen as quick a recovery in the unemployment rate, as seen in Figure 2b. As with employment, the recovery is particularly striking given how much the unemployment rate increased in the pandemic recession. Compared to this recovery, it took more than five additional years for the unemployment rate to fully recover from the Great Recession.

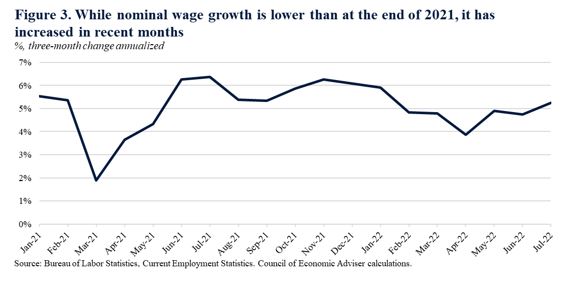

3. Monthly wage growth has increased in recent months and revisions have raised wage growth.

Nominal average hourly earnings rose 0.5 percent over the month. In addition, wage growth in June was revised up substantially by four cents, which is more than twice the average absolute value of the revisions from 2011 to 2019. Wage growth is still high relative to pre-pandemic and has been trending up in recent months, but it is lower than at the end of 2021 (Figure 3). Adjusted for inflation, recent wage growth has been negative.

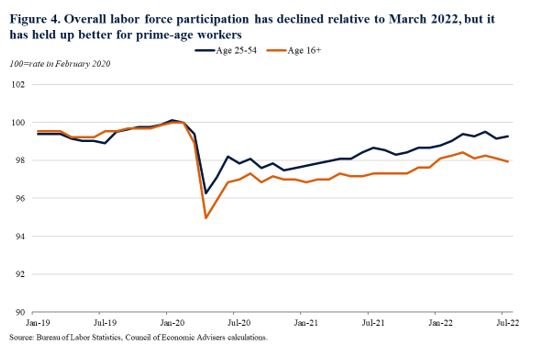

4. Overall labor force participation has declined relative to March 2022, but it has held up better for prime-age workers (workers ages 25 to 54).

Labor force participation ticked down to 62.1 percent, largely reflecting a decline in labor force participation among teenage workers. Labor force participation has declined in several months since March 2022, although it has held up better for prime-age workers. Overall, the recovery in labor force participation has been relatively strong in this recovery compared to past recoveries.

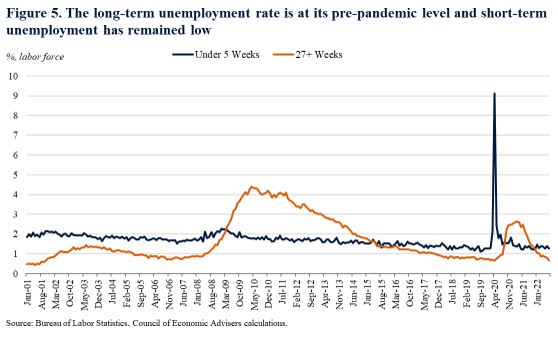

5. The long-term unemployment rate is at its pre-pandemic level, reflecting the strength of the labor market, while the short-term unemployment rate has remained low, likely reflecting the low level of layoffs.

In July, the long-term unemployment rate (27 weeks and over) fell to 0.7 percent, hitting its February 2020 level (see Figure 5). Long-term unemployment has not been as much of an issue in the pandemic recession and recovery as it was in the Great Recession, likely reflecting the strong policy response that has helped fuel economic growth.

The short-term unemployment rate (under 5 weeks) also remained low, reflecting the low rate of layoffs in the economy.

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision. Therefore, it is important not to read too much into any one monthly report, and it is informative to consider each report in the context of other data as they become available.