The DAME Tax: Making Cryptominers Pay for Costs They Impose on Others

Last month, the President released his Budget for Fiscal Year 2024, building on progress over the past two years to make critical investments to grow the economy, lower costs for families, protect and strengthen Medicare and Social Security, and reduce the deficit.

One new proposal in this year’s Budget, the Digital Asset Mining Energy (DAME) excise tax, is an example of the President’s commitment to addressing both long-standing national challenges as well as emerging risks – in this case, the economic and environmental costs of current practices for mining crypto assets (cryptomining, for short). After a phase-in period, firms would face a tax equal to 30 percent of the cost of the electricity they use in cryptomining.

Cryptomining is a process for validating transactions among holders of crypto assets to record and transfer cryptographically secured assets on a distributed ledger by, for example, using computing equipment to perform calculations to select the validator (White House 2022). Currently, cryptomining firms do not have to pay for the full cost they impose on others, in the form of local environmental pollution, higher energy prices, and the impacts of increased greenhouse gas emissions on the climate. The DAME tax encourages firms to start taking better account of the harms they impose on society.

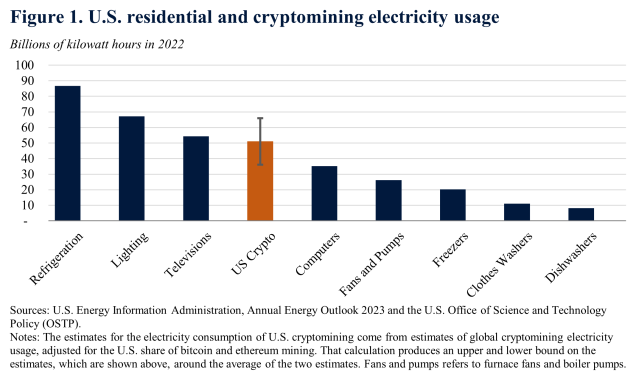

While crypto assets are virtual, the energy consumption tied to their computationally intensive production is very real and imposes very real costs, as highlighted in a chapter of this year’s Economic Report of the President (entitled “Digital Assets: Relearning Economic Principles”). Recent reporting by the New York Times highlighted the scale of the power consumption associated with 34 of the largest cryptomining operations, which they calculated as equal to the power used by the surrounding 3 million homes. As shown in Figure 1, the amount of electricity used in cryptomining in the United States in 2022 was similar to what is used to power all the country’s home computers or residential lighting.

Cryptominers’ high energy consumption has negative spillovers on the environment, quality of life, and electricity grids where these firms locate across the country (OSTP 2022). Pollution from electricity generation falls disproportionately on low-income neighborhoods and communities of color (Thind et al. 2019). Cryptominers’ intensive and often volatile power consumption also can push up electricity prices for consumers and can increase risks for local electrical grids—straining equipment, causing service interruptions and safety hazards (Chelan County 2018). Yet because cryptomining is geographically mobile and the stability of the business model remains unclear, local utilities also face financial risks if they invest in upgrading capacity that may not be needed if mining activity ceases or moves away.

The environmental impacts of cryptomining exist even when miners use existing clean power. For example, in the case of communities with hydropower where cryptomining operations are often located, increased electricity consumption by cryptominers reduces the amount of clean power available for other uses, raising prices and increasing overall reliance on dirtier sources of electricity.

Alongside these known costs and risks, cryptomining does not generate the local and national economic benefits typically associated with businesses using similar amounts of electricity. Instead, the energy is used to generate digital assets whose broader social benefits have yet to materialize, as elaborated in the Economic Report of the President. There is little evidence of benefits to local communities in the form of employment or economic opportunity, and research has found that minor increases in local tax revenue are more than offset by increased energy prices for firms and households (Benneton, Compiani, and Morse 2021).

Although the potential for cryptomining to relocate abroad—such as to areas with dirtier energy production—is a concern, other countries are also increasingly moving to restrict crypto asset mining. China banned such activity completely in 2021, as have eight other countries; three Canadian provinces also have announced or enacted cryptomining moratoriums. Similarly, some U.S. States and localities are now charging higher electricity prices for or restricting the activity.

To ensure that cryptomining is not simply pushed from one local community to another, a national policy is needed. Of course, the DAME tax is not a panacea—it is only one example of the Administration’s efforts to fight climate change, reduce energy prices, and increase access to electrified options for all Americans. Similarly, it is just one example of the President’s larger efforts to ensure the responsible development of digital assets, modernize their tax treatment, and mitigate risks to financial stability. Estimated to raise $3.5 billion in revenue over 10 years, the primary goal of the DAME tax is to start having cryptominers pay their fair share of the costs imposed on local communities and the environment.