Empowering the IRS: Understanding the Full Potential of the Inflation Reduction Act’s Historic Investment in the Internal Revenue Service

One of the most important ways that President Biden has added real fairness to the tax code is by providing the Internal Revenue Service (IRS) with the resources they need to reduce the tax gap and improve service delivery for taxpayers. The gross tax gap is the difference between what taxpayers owe and what they pay, and in 2021, it clocked in at a very large $688 billion. Even after accounting for IRS’s enforcement efforts, the net tax gap was $625 billion in 2021. The Inflation Reduction Act provided $80 billion in additional funding to the IRS, much of which is dedicated to closing the tax gap by specifically enforcing tax compliance by the wealthiest tax evaders.

We now have a new analysis from the U.S. Department of Treasury and the IRS that re-examines the revenue effect of the IRA funding. The IRS estimates that this historic investment—if sustained beyond 2031, as President Biden has proposed—would yield large returns, increasing tax revenue by as much as $851 billion over the next ten years. This estimate reflects a comprehensive methodological update, expanding traditional budgetary estimates beyond the direct impact of additional funding on enforcement to account for the effect of deterrence, updated operational practices, modernized IT infrastructure, and expanded use of data and analytics to drive efficiencies in tax administration and improve tax compliance and fairness.

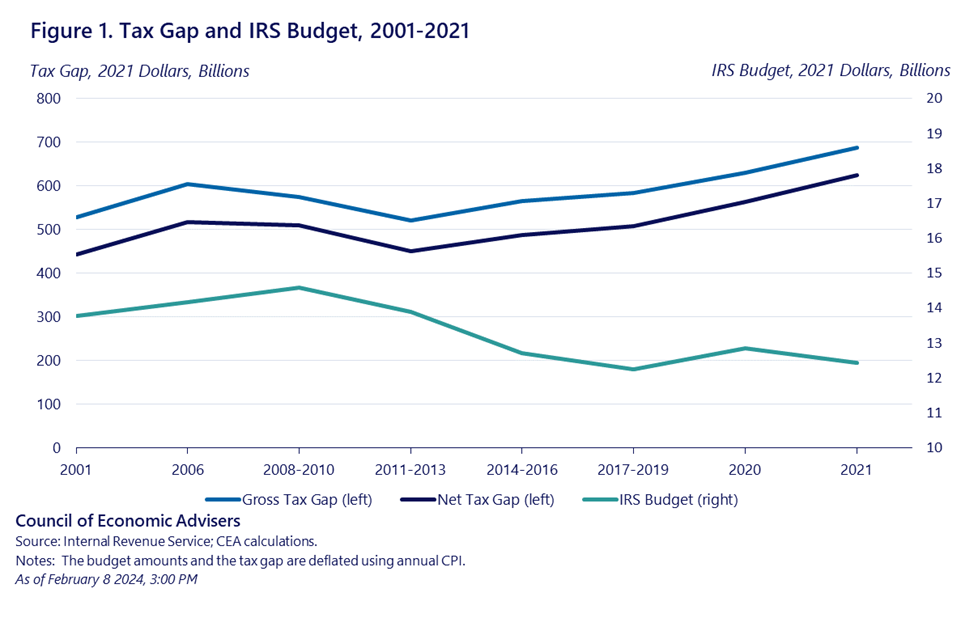

Prior to the IRA investment in the IRS, the budget of the IRS had been dwindling for many years, as shown in Figure 1. In fact, the IRS budget decreased from $15.1 billion to $12.4 billion between fiscal years 2010 and 2021 after accounting for inflation—an 18 percent decline. During the same time, the IRS lost upwards of 15,000 full-time employees (17 percent decrease), with even higher rates of decline in employees involved in examination and collections (31 percent) as well as prefiling assistance (27 percent). It should be no surprise, then, that both the gross and net tax gap climbed concurrently as the IRS’s ability to enforce the tax code was diminished by these funding cuts and personnel losses.

Despite these losses, IRS’s responsibilities have increased; for example, the IRS has been called upon to administer major legislation such as the Affordable Care Act, the Tax Cuts and Jobs Act,the Inflation Reduction Act, and distribute stimulus payments during the pandemic. This combination of shrinking resources and growing responsibilities has contributed to a growing tax gap. The most recent estimate from the IRS shows that the gross tax gap is projected to have been $688 billion for tax year 2021 (25 percent of Federal Tax Receipts and 3 percent of GDP); increasing 30 percent since 2001.

Closing the tax gap is critical for both fairness in the tax system and the fiscal outlook. First, the tax gap represents uncollected revenue that is owed under existing tax law and that the federal government could allocate towards any number of spending priorities, including deficit reduction. The sizable tax gap estimates, whether gross or net, suggest that a large source of potential federal revenue is lost to tax noncompliance; the IRS estimates that about 86 percent of taxes were paid voluntarily and/or collected by IRS enforcement activity in 2021, which means that 14 out of every 100 dollars owed to the federal government under current tax laws are projected to not be collected.

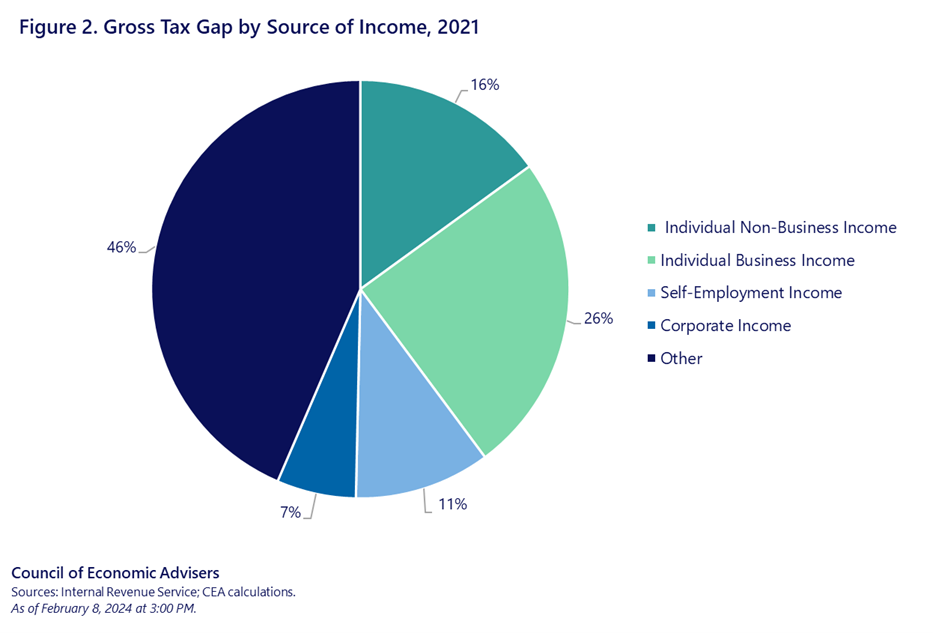

Second, the tax gap is largely driven by income sources held by the wealthy. To illustrate this, Figure 2 reports the income sources of tax noncompliance in the most recent year from which we have data. Business income reported on individual and corporate tax returns accounts for 7 and 26 percent of the gross tax gap in 2021, respectively. Unlike most wage income, these income sources are less likely to be subject to third-party reporting, which increases the likelihood for under-reporting. These income sources also make up a larger portion of income for high-income individuals. In fact, the top 10 percent of the income distribution is responsible for 64 percent of unpaid taxes. The decline in the IRS’s budget and staffing capacity has contributed to an average of 72 percent decline in audit rates for tax returns between 2010 and 2019. The audit rates for individuals earning more than $500,000 have decreased even more (86 percent). Meanwhile, recent research suggests that money spent on audits raises net revenue; $1 spent on auditing taxpayers above the 90th income percentile yields more than $12 in revenue. The IRS is focusing expanded enforcement efforts on these taxpayers, implementing the IRA consistent with Secretary of the Treasury Janet L. Yellen’s commitment that audit rates for small businesses and taxpayers earning less than $400,000 will not increase relative to historic levels.

It is helpful to provide context for the amount that this new report estimates could be raised by implementing the IRA provisions. For example, $851 billion in new revenue is equal to a 2.5 percentage point reduction in the debt-to-GDP ratio in FY2033. But perhaps most importantly, funding the IRS to close the tax gap would vastly increase the nation’s tax fairness, and do so in a way that is especially fair to working families. As noted, the vast majority of such families do not contribute to the tax gap because they pay what they owe. It is long past time for the wealthiest households to do the same.