U.S. Semiconductor Jobs are Making a Comeback

After two decades of declining or flat employment demand in the US semiconductor industry, job creation in US semiconductor manufacturing is growing again. This blog describes recent trends in semiconductor manufacturing employment and how funding and incentives created by President Biden’s CHIPS and Science Act are likely to spur continued growth in the sector.

Recent Hiring Trends

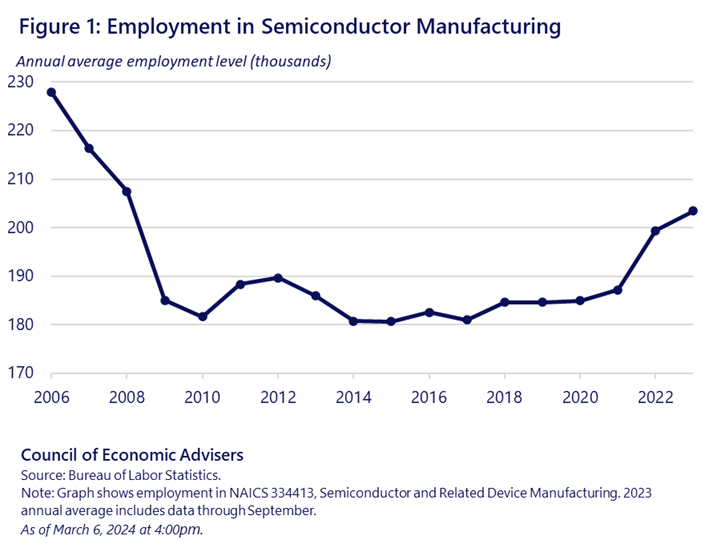

America invented the semiconductor. But in the 2000s and early 2010s, many semiconductor firms closed U.S. plants and shifted production to lower-cost locales overseas. Between 2002 and 2009, semiconductor manufacturing declined by an average of 13,400 jobs per year and by 2009, U.S. employment in the industry was lower than in the early 1990s prior to the personal computing boom.[1] Employment in the sector bottomed out in the 2010s, remaining between 180,000 to 190,000 jobs throughout the decade. In recent years, US-based semiconductor producers have tended to specialize in manufacturing processes of so-called “legacy” or “mature-node” chips used in cars and consumer electronics, while the manufacture of the most advanced logic chips has become concentrated in just a few firms and manufactured overseas.

Unlike many other sectors, semiconductor manufacturers did not carry out mass layoffs at the onset of the pandemic—likely because semiconductor manufacturing is conducted in a sterile environment and demand for electronic goods intensified during the pandemic. Hiring in the US surged in 2021 and 2022 during the global chips shortage, as legacy semiconductor producers in the US ramped up hiring at existing U.S. facilities.[2] This hiring has coincided with the passage of President Biden’s CHIPS and Science Act in 2022 – encouraging companies to invest in semiconductor manufacturing in the United States, so America can have a more resilient and domestic supply chain of semiconductors. Since 2021, semiconductor employment has increased an average of 4.3% per year to over 203,000 workers in 2023. Between 2022:Q2 and 2023:Q3, the most recent period of available data, semiconductor manufacturers added about 6,000 jobs.[3] Since early 2023, the shortage in legacy semiconductors has since eased significantly, but employment in their manufacture has not fallen accordingly. One reason is that the ubiquity of these legacy chips in personal electronics and vehicles means that there will be ongoing demand; another may be the anticipated incentives under the CHIPS and Science Act to date.

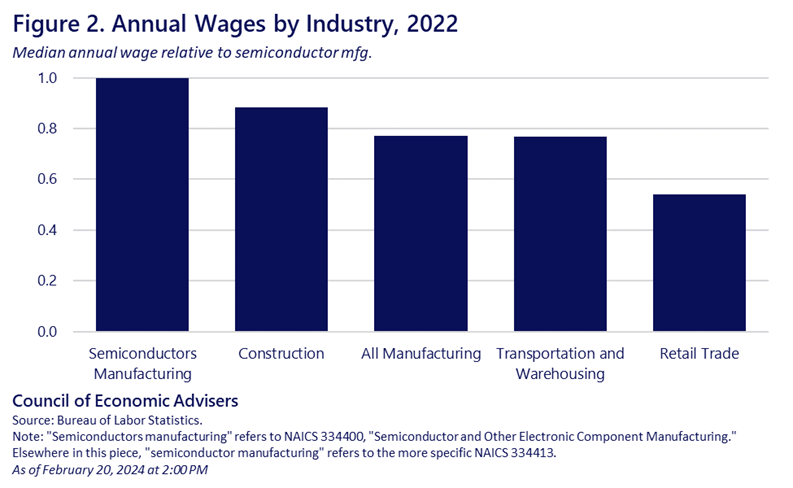

The jobs created at these facilities have typically been high-quality and well-compensated. Median annual wages in the semiconductor and other electronic component manufacturing industry[4] exceed those of both overall manufacturing and several other comparable sectors according to the Bureau of Labor Statistics (Figure 2). In particular, the median wage at these jobs is nearly double that of jobs in retail trade.

Future Hiring

Looking forward, as the unprecedented U.S. government investment in semiconductor manufacturing capacity becomes realized, hiring is poised to be strong in the years to come. The CHIPS and Science Act provides $39 billion in direct incentives for investments in domestic semiconductor manufacturing. Federal incentives aim to support investments across the semiconductor ecosystem. Since 2022, the industry has announced over $200 billion in manufacturing investments in categories such as specialized analog chips used across the entire economy, large-scale clusters for leading-edge logic chips that are powering the AI boom and the latest smartphones, and in upstream supply chain components such as specialized chemicals and silicon wafers. These investments aim to improve domestic resiliency and reduce the risk of supply chain disruptions due to geographic concentration.

The first CHIPS non-binding preliminary memorandum of terms (PMT) for funding was announced in December 2023 to modernize a mature-node production facility in Nashua, New Hampshire. However, even before the first disbursement of CHIPS funding, the promise of future funding has induced many firms to announce investments in and begin construction on new chip production facilities, creating jobs in construction and in planning and tooling factories to ramp up manufacturing. For example, two major global chip manufacturers announced new facilities in Arizona in 2021, with extensive hiring in the leadup to these plants becoming operational. Likewise, a firm in North Carolina has already made significant hires for a new plant that aims to start chip production in 2024, announcing its intent to apply for CHIPS funding as soon as construction began. Many of these newly-announced investments are for facilities that will be at the technological forefront of semiconductor production, either by producing chips with the smallest-possible transistors or by innovating with new materials.

As Federal funds flow to the semiconductor manufacturers, the CHIPS and Science Act should propel more private sector investments. Recent increases in U.S. advanced semiconductor manufacturing jobs are expected to continue as companies staff these new facilities. Investments are likely to drive demand for highly-skilled workers of all levels of education for years to come – one industry estimate expects at least 25,000 new roles for technicians without four-year degrees and a similar level of demand for highly-educated engineers by 2030 (at least a 25 percent increase in total).

[1] Of course, the sector also saw strong labor productivity gains during this period that could have lowered employment, but output in the Americas also contracted sharply relative to worldwide output.

[2] Legacy chips are made with more established processes involving larger transistors than more leading-edge processes.

[3] The most recent detailed industry-level employment data from the Quarterly Census of Employment and Wages (QCEW) from the Bureau of Labor Statistics is for 2023:Q3. There is little seasonality in semiconductor employment.

[4] Due to data availability, median annual wages for the more-specific “Semiconductor and Related Device Manufacturing” industry are unavailable. This specific subcategory makes up over half the employment in the broader category used in Figure 2.