The April 2024 Jobs Report: What’s cooler than being cool? Steady, stable growth.

The U.S. labor market added 175,000 jobs in April, another solid month for job gains, with over 60% of private-sector industries adding jobs. The unemployment rate ticked up slightly to 3.9%–it went from 3.83% to 3.86%–and the labor force participation rate held steady at 62.7%. To extract a stronger signal from the monthly data, it’s always useful to average over a few months; over the past three months, payrolls are up a strong 242,000 (see CEA’s jobs day X thread for a deeper dive into the report).

As we’ve discussed in many recent blogs, the persistently strong labor market—unemployment has now been below 4% for 27 months in row, the longest such period since the 1960s—has generated job and wage gains that are helping to power the strong, ongoing expansion.

At the same time, as economic expansions progress, we expect GDP and job growth to slow to a steadier and more stable pace than the breakneck growth pace coming out of the trough of the pandemic-induced recession. Economists have referred to this as “normalization” or sometimes, as “economic cooling.”

In this post, we show what that means in terms of some of the key variables that matter most to working households. BLUF: cooling or normalizing is necessary and positive. It irons out some of the residual kinks from the pandemic period and allows the economy to settle into a more sustainable pace, while maintaining robust job and earnings opportunities. The evidence presented below shows a cooling job market, but one that is cooling from unsustainably hot to a pace consistent with maintaining full employment conditions as well as slowly easing inflation.

Figure 1 shows the ongoing realignment of labor demand and labor supply. It simply subtracts the labor force from the sum of jobs plus vacancies. Putting aside the frictional unemployment that always persists in job markets, and making up simple numbers to elucidate the concept, if employment was 7 and there were 3 openings, demand equals 10; if the labor force also equals 10, then there’s no gap: supply and demand are aligned.

The figure shows that after sharply rebounding in 2020, labor demand soon far surpassed labor supply, a misalignment that can constrain a recovery. But as employment cooled and labor supply sped up, this measure started moving back towards its pre-pandemic level.

A relevant note on these dynamics that takes us back to today’s report is that the rebalancing of the labor market has come not from a decline in the employment rate, but from a combination of declining vacancies (reflecting cooling demand without job loss) offset by strong growth in the labor force (reflecting growing supply). One area where this important supply-side trend is particularly notable is in the labor supply of prime-age women (age 25-54). In April, their LFPR hit 78%, the highest level on record with data back to the late 1940s.

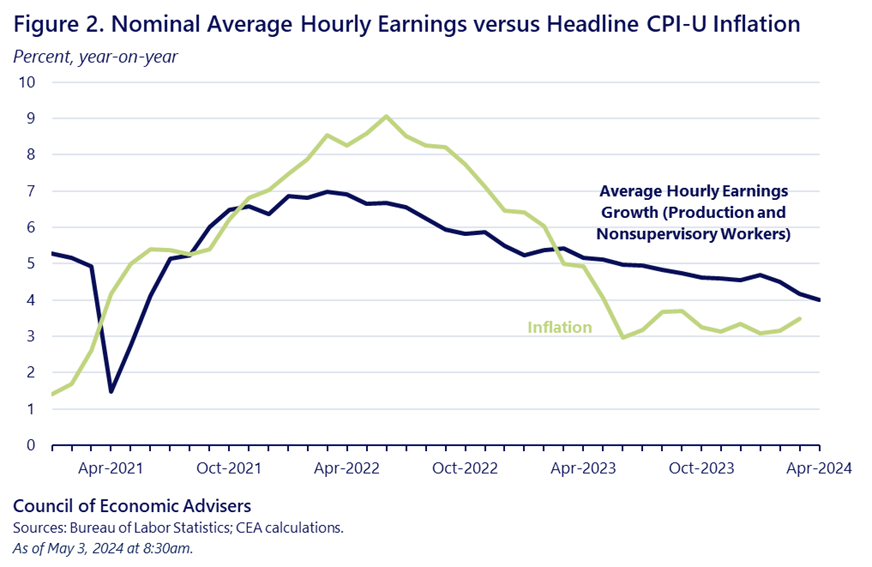

Figure 2 shows cooling wage gains, though importantly, gains that are still handily beating inflation, and have done so for over a year (note that we do not yet have April inflation data; March CPI inflation was 3.5%). The wage data here are for the 80% of private sector workers in non-managerial or blue-collar jobs. Over the past year, pay is up 4% for these low- and middle-wage workers. Driven by the sharp labor demand-over-supply pattern in the above figure, nominal wage growth for middle-wage workers spiked up to 7% in early 2022, but has gradually cooled to 4% in April.

As noted, for the past year or so, this wage series has outpaced inflation, meaning yearly real wage gains and greater purchasing power of these workers’ paychecks.

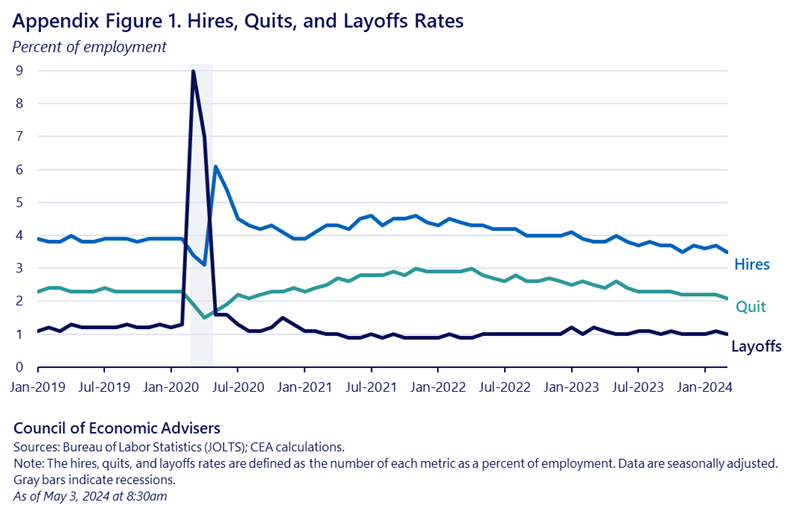

The appendix shows a figure from the recent Job Openings and Labor Turnover Survey that captures other aspects of the cooling labor market. Importantly, quits have come down notably since their COVID peak, reflecting both that the shift to more preferable jobs and work schedules that occurred after COVID has largely ended, as well as that labor demand has cooled. Cooling demand is also shown by the decline in the hiring rate. In contrast, the layoff rate has been stable, underscoring the point that labor-market is cooling to a more sustainable pace while still delivering solid job and wage growth.

We learned at least two things this morning about the U.S. labor market. First, most importantly, we learned that employers continue to hire at a strong pace, helping to generate record spells of both low unemployment and high women’s LFPRs. Second, we learned that as the pandemic continues to fade into the rear-view mirror, some key economic misalignments are realigning in a manner consistent with steady, stable, sustainable growth.

Appendix